A new mine for Woodlark island?

MPI will be focusing on Woodlark Island in 2015 due to concerns raised by communities about mining impacts, especially from the disposal of mine waste into the sea, and the poor transparency record of the proponent, Kula Gold. In this first of a series of articles, we provide a basic outline of the project and raise a few questions.

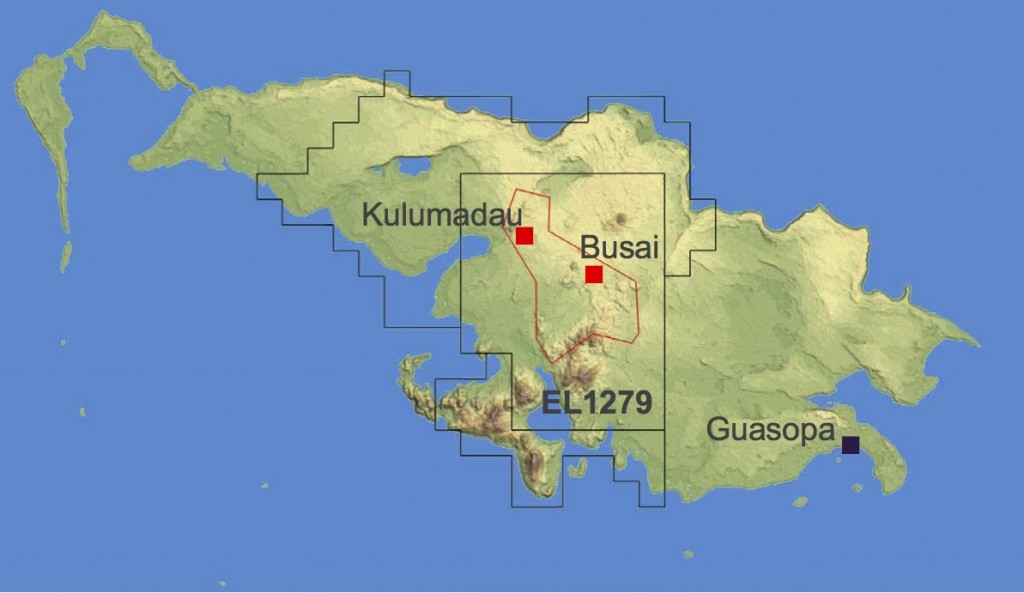

Woodlark Island, also known as Muyua, is one of a group of islands in the Solomon Sea, which lies between Alatou, on the mainland of Papua New Guinea (PNG) and the New Britain, Bougainville and the Solmon Islands (map). Located in the Milne Bay Province it is a relatively large island (app. 90, 000ha), isolated by PNG standards, with a mainly subsistence population of 6000 people.

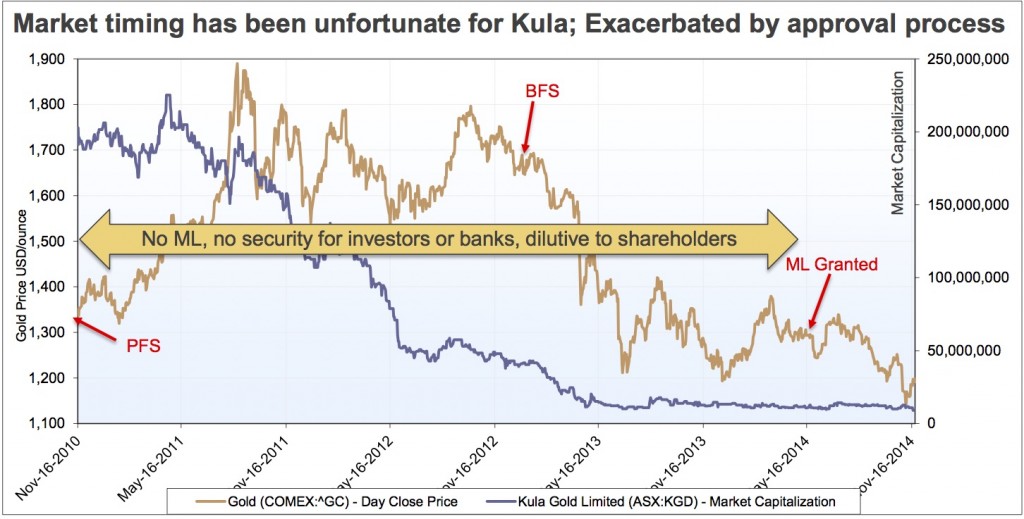

The proponent, Kula Gold, has been promoting the projected low-cost operation, linking that to ongoing exploration and additional mining at Woodlark Island. Kula Gold is a small company, with no mining experience, no other significant projects or assets and a fluctuating value of $10-20m AUD over the last six months. They have been actively seeking $200m in finance to develop the site through debt, partners or a joint venture for some time. With construction scheduled to commence in early 2013, the project is now two years behind.

Project History

In July 2014, Kula Gold was granted a Mining Lease (ML508, 5960.49 ha) for the proposed development and operation of the Woodlark Island Gold Project. The mining lease facilitates the exploitation of deposits identified within Exploration Lease 1279 (EL1279). Two additional and adjacent exploration leases (EL1465 & EL1172), are being actively explored but there are no formal proposals to mine them at this time.

The mining lease and the two exploration leases combine to cover half the land area of Woodlark Island. The project is similar in scale to the Simberi project in the New Ireland Province. The granted Mining Lease allows for the continued development of the projected 1.8 Mtpa gold mining operation. The mine is expected to operate for nine years but the lease allows for an extension for a further period not exceeding ten years if required.

The project has a complex and chequered history of ownership, which dates back to 1988. It started as joint venture between BHP Utah and Nord Resources. During this period, regional exploration, a drilling program and a prefeasibility assessment were undertaken. In 1989, the project was taken over by Highlands Gold, which was subsequently acquired by Auridium Gold. In 1996, Auridium Gold prepared a number of reports including another feasibility study. From 1998 to 2004 the project was undertaken as a joint venture between Auridium (PNG) Ltd. and Battlefield.

In 2004 the project was acquired by BDM Mining Limited (which wholly owned WML 2005-7) until it was bought by Kula Gold in 2007. The project is currently operated by Woodlark Mining Limited (WML), which is wholly owned subsidiary of Kula Gold, an Australian company that listed on the Australian Stock Exchange in November 2010.

(Image: Map above and graph, Kula Gold)

In accordance with the conditions of all exploration licences issued under the current PNG Mining Act, the State of PNG has the option to acquire a participating interest of up to 30% by the payment of sunk costs and by contributing to construction capital costs on a basis pro rata to the percentage of the project acquired. The PNG government has exercised this option and has acquired a 5% interest with the option to undertake a further acquisition of up to 25% in the project. Any proceeds from this interest are expected to be distributed between local landowners and the Milne Bay Provincial Government. The state’s return on investment will be entirely dependent on the success of the project: which in turn is impacted by the investment costs to date; the cost of building the mine; the gold price; financing costs; Kula Gold’s management of an island mine in a remote location; and community relationships.

Mining lease assessment process

The environmental impact process set out by the PNG Environment Act 2000 prescribes three stages of project evaluation. The first stage involved a notification of preparatory work and this was submitted to the Department of Environment and Conservation (DEC) in October 2009. The DEC then advised WML that, under the Act, the project constituted a Level 3 activity and therefore an Environmental Impact Statement (EIS) would be required.

The second stage consisted of an Environmental Inception Report (EIR) and this was submitted at the end of March 2011. An EIR has a statutory 60 day period of review after which if no feedback is received by the proponent from the DEC, the report is deemed to have been accepted. In this case, the DEC provided feedback three months after the statutory period. An EIS was prepared and submitted to the DEC in January 2013. This report was a combination consolidation of existing EIS reports and new investigations. In the EIS, WML indicated that feedback on the EIR from the DEC was included in the EIS process ‘where possible’.

The EIS process included an independent technical review, a public consultation process, presentations to various PNG statutory bodies and a final recommendation by the Environment Council to the Environment Minister to grant the Project Environment Permit. In early 2014 the Environment Permit for the development of the Woodlark Island Gold Project was granted. This meant that all necessary regulatory approvals to commence the development phase of the project had been granted. The following sections give a brief overview of the project and stakeholder engagements.

Mine description

The Woodlark mine will be an open cut mine with four pits. An estimated 11 Mt of ore will be mined producing over 800,000 oz of gold at an average rate of 90,000 oz per year. The four pits are located in the centre of the island near the village settlements of Kulumadau. The pits are: Busai (46 ha); Kulumadau (25.79 ha); Woodlark King (103.43 ha) and Kulumadau East (9.14 ha). The pits are separated from north (Kulumadau) to south (Woodlark King) by about 10 km.

The mine is expected to produce 12.6 Mt of tailings which will be piped overland and discharged into Wamunon Bay in the Pacific Ocean some 10 km to the north east of the mine site. In PNG, marine mine waste disposal (MMWD) is also carried out at the Simberi, Lihir and Ramu mines and was carried out at the now closed Misima mine. The disposal of mine waste at sea has proven to be very controversial in PNG and was the subject on a series of court cases involving the Ramu Nickel mine and Basumuk Bay refinery.

Extensive new infrastructure is required including roads, camps, power generation and transmission facilities, wharves and warehousing. The mine will be served by an existing airstrip at Guasopa (the principal airstrip for the island) 30 km to the south-east. This will be upgraded for the project and will require construction of new roads to access it. Quarries will be needed to supply building materials and will be constructed adjacent to infrastructure where possible. Ore processing will carried out by techniques commonly used in Australia and identical to those used in the Simberi, Hidden Valley and the former Misima mine.

During the exploration phase, the mine has supported a workforce of approximately 350 people. During construction and operations the workforce is expected to be between 300 and 500. It is estimated that during all phases of the project 60% of the workforce will be PNG locals. Accommodation will be constructed for about 200 workers, mainly fly-in fly-out while local employees are expected to remain resident in local villages. The various levels of PNG government and local communities have expressed concern about the opportunities to maximise local employment opportunities during the operational phase of the project.

The EIS argues that the project will create important continuity within the mining sector and provide PNG with the maintenance of mining-related expertise. WML consider this important since as they believe existing (unspecified) mines will have closed or will be nearing closure. The mine is purported to provide numerous, though unquantified, economic benefits. The EIS points out that there are likely to be ‘substantial’ economic multipliers associated with project. More tangible benefits such as wages, royalties and compensation are indicated to be about 7 million US dollars.

Community and stakeholder consultation

Stakeholder engagement carried out for the EIS was a result of the directive of three main sources. The most significant of these is the PNG Environment Act 2000. The EIS also states that WML will strive to meet “a number international standards and guidelines” (unspecified) that relate to community engagement and development where possible and practical.

WML also has developed its own social policies In the EIS these policies are limited to generic principles that include respect and recognition of cultures and values, transparency and consultation and seeking create lasting (temporally unspecific, presumably for the duration of the mine) relationships built on trust and mutual respect. To this end, WML consider that local communities have been consulted and ‘informed’ of planned mining and mine-related activities.

A number of global environment Non-Governmental Organisations (NGO’s) and religious organisations are listed within the EIS as being potential stakeholders. Though the EIS gives no indication wether these or any NGO groups have been involved in any of the key phases of EIS development or whether any on-going engagement is planned. It appears likely that opportunities for social development partnerships with any NGO’s have not yet been pursued.

The Mineral Policy Institute (MPI), which is a mining specialist NGO with 20 years experience watching the mining industry in PNG, had requested a copy of the EIS and to be involved in the consultation as early as July 2013, before the EIS was released for public consultation. Despite being told then that the EIS would be available, that request and a further seven separate requests, made between August 2013 to December 2014, via phone, email and in-person were all rejected by Kula Gold Directors. According to MPI Executive Director, Charles Roche,

“…this poor level of transparency is astounding, how can any company pretend to be undertaking consultation while deliberately hiding basic source documents? Kula Gold have undermined the PNG consultation process and are an embarrassment to their directors and to mining industry in PNG, which purports to have higher standards.”

Comparing the above (corroborated by MPI notes and correspondence) to the statutory definitions and undertaking in the EIS, it would appear that Kula Gold withheld access to the EIS and failed to consult with the MPI despite repeated requests, statutory obligations and company statements to the contrary in the EIS.

Local communities (villages) were assessed according to their geographical proximity to the mine site and three levels of impact were determined. These were ‘direct’, ‘indirect’ or ‘minimal’. Other than a rudimentary assessment of geographical proximity to the mine itself it is not clear how the needs of each of these villages were assessed.

The only village considered to be directly impacted by the mine was Kulumandau. The direct impact consists of relocating Kulumandau village, which will involve the relocation of 507 people (nearly 10% of the population of Woodlark Island), 151 private houses, 2 small stores and 2 churches as well as various other assorted buildings.

Stakeholder engagement activities was conducted primarily by a series of four information roadshows in which stakeholder information was ‘tailored’ to meet the needs of each stakeholder group taking into account both their interest and understanding of the project and how they may be affected by the project. In October 2011 an EIR roadshow was undertaken in which information was presented to 10 villages across Woodlark Island. Approximately 315 adults or less than 10% of the islands inhabitants, attended this series of presentations which were undertaken with the involvement of the DEC, Government agencies and Milne Bay provincial administration representatives.

Two EISA roadshows were presented the first of these between May and June 2012. A second was planned completed in December 2012, but no details are given within the EIA which was dated January 2013. The roadshows were advertised between two and four weeks prior to the event. Four additional villages (Ungomon, Unmatana, Suloga and Boagis) were added to the original ten. It is unclear why the additional villages were added at this stage. The presentation in Kulumadau, which will be relocated, and had a population of 662 (in 2010), was the worst attended, with only 50 people, or 7% of the village population participating.

An EIS roadshow was planned for early 2013,but there is no indication in the EIS document that this has been undertaken. WML have indicated that it will undertake stakeholder engagement by its own community affairs team and will facilitate communication with the local communities by eleven ‘enrolled’ representatives. These ‘credible’ and ‘trusted’ representatives will liaise between their communities and WML. It is unclear report how the representatives were selected, how the qualities of credibility and trustworthiness were measured and whether they were assessed by WML, the local communities or both.

Throughout the EIA and EIS stages of the project a number of key issues have been raised by stakeholders. Key concerns have included the fact that relocation will necessitate sections of land need to be retitled and returned to traditional owners. The lack of specific plans for relocation and compensation of affected villagers has also been highlighted. There have been concerns expressed about on-going uncertainties about the timeframe of the project including additional exploration activity associated with an adjacent Exploration lease (EL1465). MMWD have caused numerous concerns, particularly impact to the marine environment and fishing activities.

In addition to the above, it is evident that there is a number of concerns from those on Woodlark Island but also in communities living within and bordering on the Solomon Sea, these include: the relocation of villages/ers; the avoidance of and poor consultation practices; a lack of transparency and participation; the inexperience of the company and it’s relative size compared to the project; the prospect of additional exploration and mining, potentially over 50% of the island; delays in the EIR process; and finally the impacts from MMWD.

Ed: MMWD is also known by two other acroyms, STD or submarine tailings disposal/dumping and DSTP, deep sea tailings placement, neither of which are accurate, whereas marine mine waste disposal is exactly like it says, mine waste disposed of in the ocean/sea/estuary.